Solar to the People – Helping you get the best price on solar

The Federal Solar Tax Credit (ITC) Explained

Discover how much you can save today with our solar calculator

What is The Investment Tax Credit (ITC)?

The Investment Tax Credit (ITC), popularly known as the federal solar tax credit, is THE most important solar credit. It provides a tax credit of 26% for the purchase price of a solar system against your federal income taxes, and covers both residential and commercial solar installations, bringing down the cost of the system enormously. EVERY person in the US who installs a solar system is allowed to claim this credit on their federal income taxes

Put simply: You get 26% of the cost of a solar system back as a tax credit.

2021 Update: The COVID relief and spending bill passed by Congress and signed into law have extended the ITC for another two years.

This welcome news came right as the previous law was set to drop the ITC to 22%. Now, the 26% tax credit will remain in effect for two more years. It will then drop to 22% in 2023 before disappearing in 2024.

How Does the Federal Solar Tax Credit (ITC) Work? An Example:

- Cost of home solar installation before federal tax credit = $22,000

- Value of the investment tax credit = $22,000 x 26% = $5,720

- Total cost of home solar installation (excluding any state or local rebates, payments for power produced, etc) = $22,000 – $5,720 = $16,280

Is There a Limit to the Size of the Federal Solar Tax Credit (ITC)?

There is no limit to how much of a tax credit the ITC provides, and with US prices for residential solar systems averaging roughly $22,000, homeowners who purchase their system with cash or through a loan can save $5,720 on their system due to the ITC. A tax credit of 26% towards the cost of a solar panel installation is enormous – and you are able to take all of this tax credit in the year you install your solar system.

What if you Don’t Have Enough Federal Tax Liability in the Year the Panels are Installed?

While most people installing systems have enough federal tax liability to take the entire credit in the first year, you are allowed to roll it over into a second year. Rolling it into the third year is a subject of debate among accountants – it’s best to use your tax credit within two years of installing your system.

Who is Eligible for the Credit?

Everyone who installs a solar system in the US in an election year is eligible for the Investment Tax Credit, and as long as your accountant fills out the proper paperwork correctly there is nothing that should stop you from receiving the credit.

What is an Eligible Year when it Comes to the Federal Solar Tax Credit (ITC)?

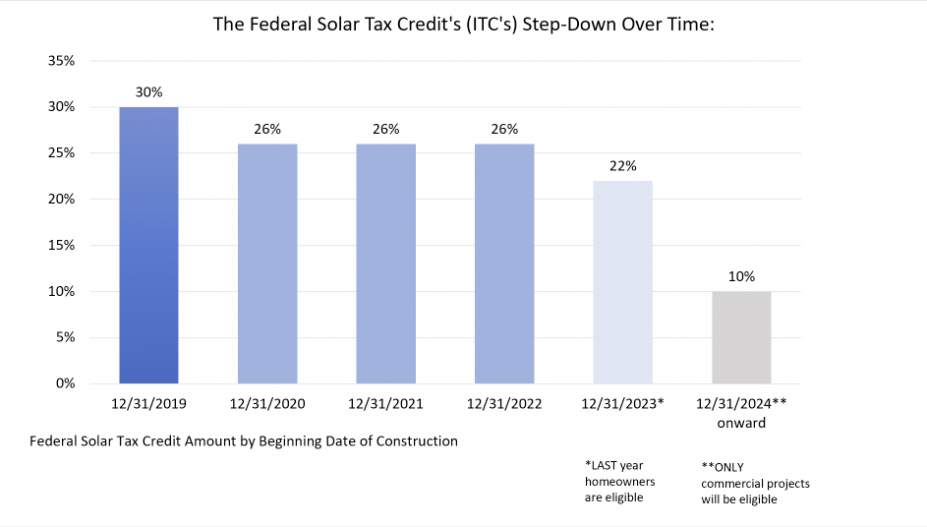

This part is IMPORTANT. The ITC is going to be ramping down over time – meaning that the longer you wait on going solar, the lower of a solar panel tax credit you will receive.

See the below diagram for the ramping down of the ITC over time – what this graph indicates is that if you have begun construction on your solar panel installation before December 31st, 2022, you will be eligible for the full 26% tax credit. Installations that began between January 1, 2023, and December 31, 2023, will be eligible for a 22% tax credit. After that, there will be NO tax credit for homeowners, only commercial solar installations.

Why is it Called the Investment Tax Credit instead of the Federal Solar Tax Credit?

That just happens to be the name that it was given by congress – many people are confused by why it wasn’t called the Federal Solar Tax Credit or something – we are too. Solar IS an investment that provides handsome returns – but we agree, they could have come up with a better name.

A Quick Note Regarding Tax Information:

We’re NOT accountants or tax professionals! Please make sure to verify any tax information with a qualified professional.