A Decade of Growth in the California Solar Installation Industry

California, long the vanguard of renewable energy development in the United States, has seen extraordinary growth in the residential solar installation during the 2010s. The Golden State’s efforts to drive the adoption of renewables have yielded remarkable results as clean energy continues to grow. The last decade featured a 675% increase in annual residential solar installation along with a precipitous drop in the cost of solar in California. As a competition, innovation, consumer acceptance, and the new solar mandate drive prices down even further, the rate of new solar installation is picking up yet again.

Key Findings

– From 2010 to 2019, California had 838,569 total new residential solar installations, as annual installs increased by 675%.

– Each year since 2013, California has added more new residential solar installations than the cumulative total of 51,812 home solar systems completed prior to 2010.

– 2019 saw a record high of 143,312 residential installs, up 12.9% year-over-year.

– Rural areas had some of the highest installs on a per 1,000 resident basis, however, urban centers had the highest installation totals.

– The total cost of installation dropped 12.4% while the average system size rose from 5.5kW to 7.0kW statewide, highlighting the rapidly evolving residential solar industry.

Our analysis is based on ten year’s worth of solar installation data from the NEM Interconnected Data Set of investor-owned utilities in California. The data show that incentives provided a successful jumpstart to the residential solar industry in California. Excluded from this analysis are noteworthy increases in commercial, governmental, and nonprofit solar installations. A few notable municipal utilities are not included due to data inaccessibility.

838,569

From 2010 to 2019 total new residential solar installations in California.

7.0 kW

The average system size rose from 5.5kW to 7.0kW statewide.

1,654%

The total residential solar installations in California increased by 1,654% from 2009 to 2019

2019 Marked a Return to Sky-High Growth of Residential Solar Installation

Topping off a decade of accelerating solar installation, 2019 finished with an all-time record of 12.9% growth in new residential solar installations. Annual solar installation numbers skyrocketed in 2019 to a new high of 143,312. Growth was widespread in every metropolitan area, but less populated counties had remarkable growth as well. Across the state, installations reached a record high of 3.63 per 1,000 residents, up from 0.5 per 1,000 residents in 2010.

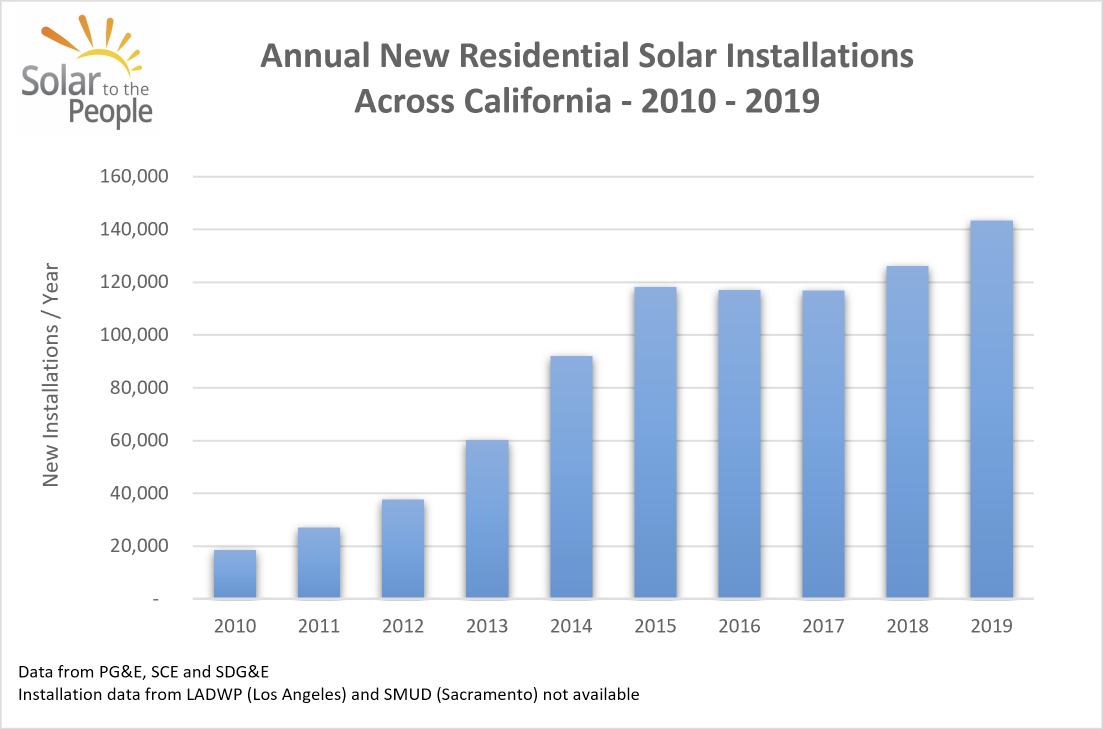

A breakdown of annual data from the 2010s reveals the remarkable growth of residential solar over a relatively short period of time. In 2010, there was a statewide total of 18,498 homes that went solar. There were 143,312 new installs in 2019, a 675% increase in annual installations over the decade.

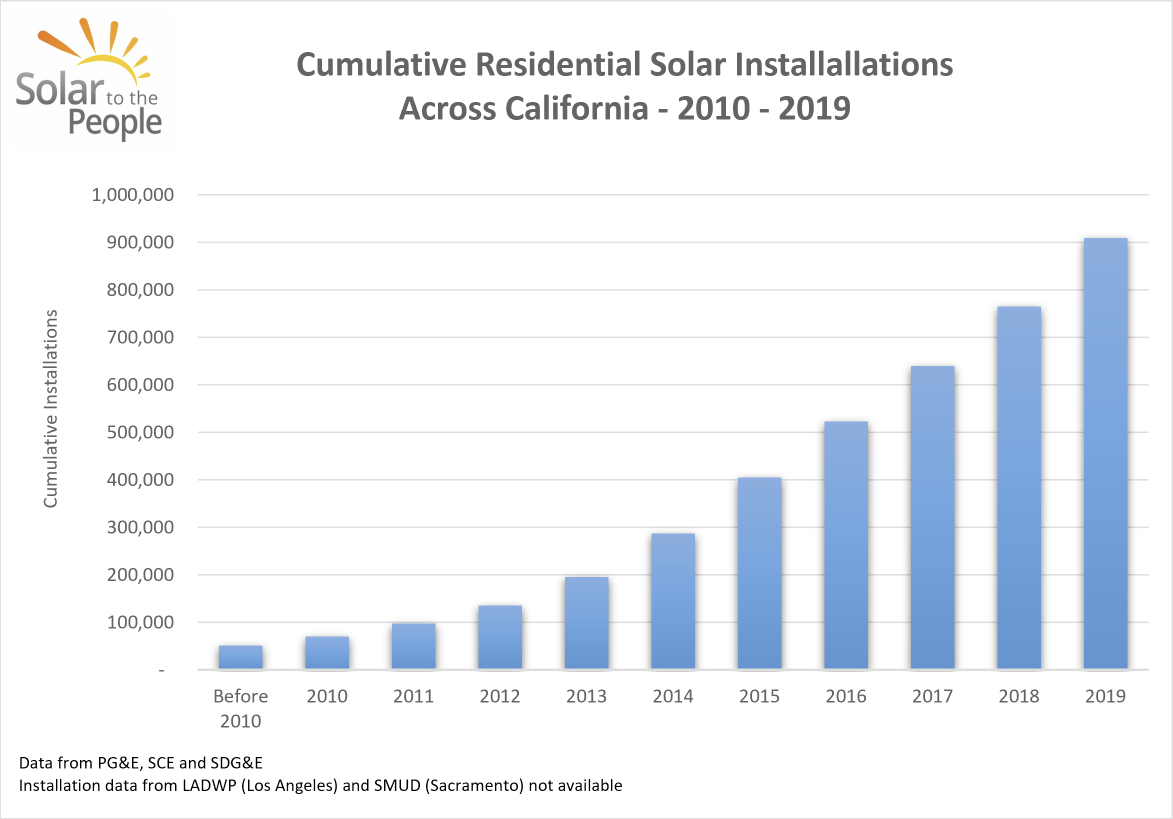

Prior to 2010, the three first decades of accessible solar energy technologies only resulted in a cumulative total of 51,812 installations in the Golden State based on our data set.1 The 2010s really marked a turning point in the industry, as the number of total installs nearly doubled from 2009-2011, then again from 2011-2013 and doubling yet again from 2013-2015. During the pause in the growth rate of 2016-2017, new installation rates remained at near-record highs. By 2019, cumulative installs (including the 51,812 from before 2010) had more than doubled from 405,621 in 2015 to an astounding 908,879. This ultimately resulted in a 1,654% increase in cumulative residential solar installation from 2009 to 2019.

| Year | Before 2010 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

| Total Installations | 51,812 | 70,310 | 97,455 | 135,184 | 195,493 | 287,444 | 405,621 | 522,657 | 639,441 | 765,567 | 908,879 |

The 2010s Were a Breakout Decade for Solar in California

Incentives, dropping prices, homeowner acceptance of solar, and the push to decarbonize electricity generation spurred record growth of home solar installation during the decade. Between 2010 and 2019, California had 838,569 total new installs of residential solar. For perspective, prior to 2010 there was a cumulative total of 51,812 residential solar installations across the state. By 2013, more than 60,000 new residential solar installations were added annually. Annual new residential solar installations increased every year, with the exception of 2016-2017. Even when the rate of installations flatlined during that period, the pace of solar installation remained at near-record levels before increasing again in 2018 and 2019. Waning incentives may have contributed to a pause in the growth rate in 2016-2017, but numbers held strong throughout the period at over 115,000 new installations per year.

A total of 233,820 new installations were added in 2016-2017, roughly equal to the cumulative statewide total in 2014.

As the pace picked up yet again, a new high of 126,126 new installations was added in 2018 followed by yet another record of 143,312 in 2019.

Solar Installation Regional Breakdown

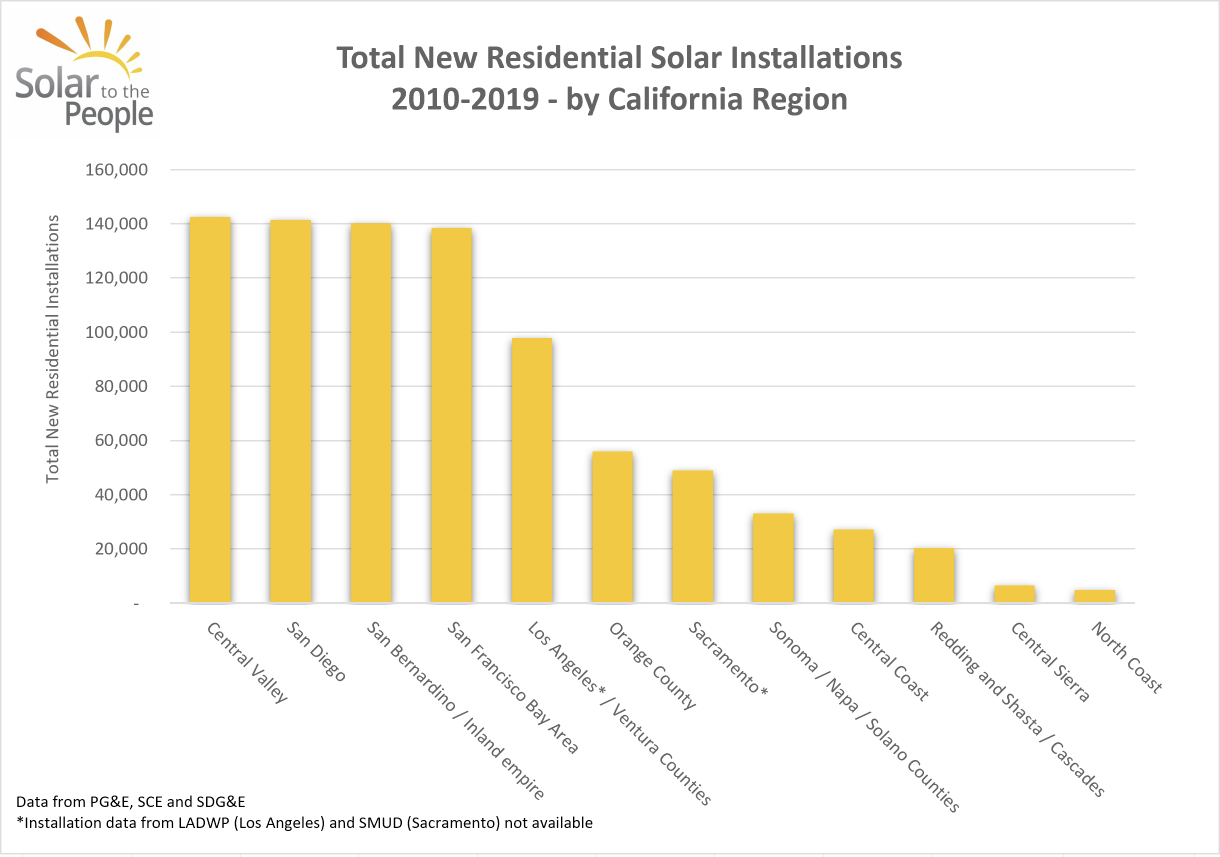

Despite the varied population distribution across California, it’s clear that the solar boom has reached every corner of the state. Unsurprisingly, the population centers of California saw the highest numbers of residential solar installation over the decade, with the Central Valley, San Diego, San Bernardino, and San Francisco regions each totaling over 100,000. Los Angeles and Ventura Counties are close behind at 97,822 residential installations from the NEMS dataset, but there’s a noteworthy caveat. Unfortunately, data from the publicly-owned Los Angeles Department of Water and Power, Sacramento Municipal Utility District and a few smaller utilities are not accessible.1 We’d expect the Los Angeles and Sacramento numbers to be higher, and they almost certainly are.

Total New Residential Solar Installations, 2010-2019

| Region | Number of Installations |

| Central Valley | 142,565 |

| San Diego | 141, 478 |

| San Bernardino / Inland Empire | 140,111 |

| San Francisco Bay Area | 138,448 |

| Los Angeles / Ventura Counties | 97,822 |

| Orange County | 55,998 |

| Sacramento | 48,896 |

| Sonoma / Napa / Solano Counties | 32,974 |

| Central Coast | 27,100 |

| Redding and Shasta / Cascades | 20,375 |

| Central Sierra | 6,553 |

| North Coast | 4,743 |

| Total: | 857,063 |

If we focus solely on the number of installations, heavily populated metropolitan areas are clearly the winners. However, we can have a standardized comparison for all regions of the state by looking at the same data but in terms of residential solar installations per 1,000 residents – this allows us to control for differences in population.

By looking at residential solar installation per 1,000 residents, we see that the transition to solar energy is much more widespread than the absolute numbers would indicate – and this is where it gets interesting.

This ‘apples-to-apples’ comparison shines a light on some notable trends: Several rural regions are solar leaders, and multi-family housing and fewer suitable rooftops probably contribute to lowering the totals in some urban regions when looking at installations per 1,000 residents.

Total New Residential Solar Installation Per 1,000 Residents, 2010-2019

| Region | Solar Installations Per 1000 Residents |

| San Diego | 42.38 |

| Central Sierra | 34.52 |

| Central Valley | 32.93 |

| Redding and Shasta / Cascades | 31.15 |

| Sonoma / Napa / Solano Counties | 30.54 |

| San Bernardino / Inland Empire | 29.00 |

| Central Coast | 23.29 |

| San Francisco Bay Area | 19.97 |

| Sacramento | 19.09 |

| Orange County | 17.63 |

| North Coast | 16.54 |

| Los Angeles / Ventura Counties | 8.99 |

The two leaders of cumulative solar installation per 1,000 residents over the decade are San Diego at 42.38 per 1,000 and the Central Sierra with 34.52 per 1,000. Fascinatingly, San Diego is one of the biggest regions by population and the Central Sierra is the smallest region by population. Orange County has not been a leader in solar growth, with a cumulative 17.63 residential installations per 1,000 residents. Here you can see the impact of the Los Angeles/Ventura and Sacramento data not fully being included.1

Statewide, annual new solar installation increased from 0.50 per 1,000 residents in 2010 to 3.63 in 2019. Nearly every year saw an uptick in new solar installation, with a brief respite in 2016-2017. California’s population grew by over 6% in the 2010s, yet annual solar installation increased at a far greater pace.

The cumulative numbers paint a picture of intense growth.

Cumulatively, statewide installations per 1,000 residents jumped from 0.47 in 2010 to 21.74 in 2019. During the pause in California’s annual new solar installation growth rate during 2015-2017, the number of statewide installations per 1,000 residents managed to climb from 8.97 in 2015 to 14.90 in 2017.

Despite the “steady” state of new installations, total installations in California continued to reach new heights during this period as the state’s solar installation industry grew.

More Affordable Solar Brought More Installs and Bigger Systems

The price of solar installations, both on a price per watt and full system cost level, has dropped massively over the past decade. Overall, the average cost per watt of solar installed dropped from $3.41 in 2015 (the first year of solar cost data in our solar cost index) to $2.34 in 2019 after savings from the ITC. This equals an average drop of 31% across the state, with the greatest reductions in cost coming from Napa, Sonoma and Solano Counties where prices dropped over 43%. The Bay Area, San Diego, Los Angeles and Orange County are among the regions that saw at least a 30% decrease in cost per watt after incentives.

The total cost of installation declined from $18,649 in 2015 to $16,298 in 2019 after incentives. This 12.4% drop occurred while the average system size rose from 5.5kW to 7.0kW statewide. Affordable hardware, wider public acceptance of residential solar, industry competition and remaining incentives are all working to drive down the out of pocket cost of going solar in California.

Incentives Change, But the Sun Keeps Shining

Solar incentives have been designed to ramp down over time, which has worked extraordinarily well since the cost of solar across California has fallen drastically over the same period. The cost of residential solar per watt has dropped by 31% over the past five years, reaching a new record low of $2.34 per watt in 2019. Slashed costs have more than offset the phase-out of some incentives following years of high participation in state l programs aimed at making solar more affordable. In fact, dropping prices outpaced the phase-out of incentives to the extent that installations have continued to grow in size as homeowners continue to transition to residential solar systems in greater and greater numbers. From 2015 to 2019, the average size of a residential system in California increased by 27%, yet the average total cost of installation managed to fall by nearly 12% over the same period.

The federal solar investment tax credit (ITC) launched in 2006 to cover 30% of solar installation costs. Nationwide, there’s been 52% average annual growth across the solar industry since the ITC was enacted. The California data reflects a decade of ITC benefits in addition to state and local incentives. The California Solar Initiative was a generous state incentive that expired in 2016 after 12 years of support. Despite the reduction in state-level incentives, the rate of new solar installation picked up once again in both 2018 and 2019 as prices continued to plummet. In 2020, the ITC ramped down to 26% with a decrease to 22% to follow in 2021. The ITC extension passed by congress in 2015 calls for the elimination of the entire credit in 2022. The impacts of the eventual phase-out of the investment tax credit remain to be seen.

Looking To The Future

The California solar mandate is expected to be a catalyst for continued growth in residential solar. Policy aside, innovation and market competition are forecast to drive prices down further. Total costs are forecast to decline by an additional 34% between 2020 and 2030 across the solar industry.

The federal solar investment tax credit is on track to expire in 2022, but new legislation remains a possibility for future extensions. Likewise, state and local incentives can change on a moment’s notice. In California, updates to net metering (NEM) have brought some changes to residential solar. NEM 1.0 included limits to the number of homes that could take advantage of net metering. With NEM 2.0 there is no limit to the number of homes that can receive utility bill credits for the excess energy their solar system produces. Another change included in NEM 2.0 requires that solar customers move to time-of-use utility rates. This shift may get more homeowners thinking about solar plus storage in years to come.

As of 2018, 86% of US small-scale battery storage is in California, but batteries are rapidly gaining popularity worldwide as the economics become a no-brainer. From 2015 to 2017, average costs per-unit of energy capacity fell by 61%. Solar plus storage comprised just 4.11% of nationwide distributed solar systems in 2019, but that proportion is forecast to grow to 26% in 2025. Affordability and enhanced battery chemistry are making this new technology more accessible in residential settings. Coupled with more affordable home battery options, solar is providing power around the clock for more residential energy consumers.

Affordability, battery storage, and incentives all bode well for the future of the California residential solar industry. The 2010s saw a 675% increase in annual residential solar installation as total installations reached 3.63 per 1,000 residents. Incentives, plummeting prices, and a desire for carbon-free energy independence resulted in 838,569 total new installs of residential solar during the decade. With the new California solar mandate, prices approaching $2 per watt, and the added benefits of battery storage, the future is bright for the California residential solar industry in the 2020s.