Solar Loans

Discover how much you can save today with our solar calculator

Finance your Solar System with Solar Loans

Solar loans are rapidly becoming one of the most popular choices for financing solar today.

They frequently provide better overall savings than solar leases or different types of power purchase agreements.

The reason for that is the fact that with solar loans you own the system and can receive all of the available rebates and incentives, including the federal Investment Tax Credit of 30 percent. In addition, you don’t have to pay for solar lease maintenance costs or profit margins.

Most importantly with the advent of zero-down solar loans (loans where no upfront payment is required), homeowners are able to immediately start saving on their power bill, while increasing the value of their home by the value of their panels.

Benefits of solar loans in a glance:

- Ownership of your solar system

- Loan is taken out to finance the cost of the system – you pay it back over time

- Many loans are $0 down – allows you to start receiving benefits of solar power immediately

- You’re entitled to any available incentives and rebates

- There are a variety of providers to choose from for a loan

Is Solar Loan Right for me?

Loans are ideal for homeowners who:

- Want to own their panels but don’t want to pay cash up-front.

- Want to immediately add the value of your solar system to the value of their home.

- Are willing to do a little more legwork and monitoring to ensure they get the maximum savings available.

Read About – Is it Better to Lease or Buy Solar Panels?

How Do Solar Loans Work?

Solar loans are loans issued expressly for putting solar panels on a house.

They have a principal amount, an annual interest rate, monthly payment requirements, and a payback period, just like any other loan.

For example, you might see a $20,000 solar loan with a 4.5% interest rate, and a fifteen-year payback period.

These loans work quite similarly to a home improvement loan or an auto loan.

Solar installers, banks, credit unions, PACE program participants and independent financing companies all provide loans, so the options for homeowners are increasing all the time. These providers are creating new loan options all the time, so it is becoming easier and easier for homeowners to find a loan that fits their exact residential solar financing needs.

Solar Loan Advantages:

- Solar loans frequently have the highest net savings of all the financing types, with the exception of cash purchases.

- Unlike leases and PPAs, loans allow you to own your solar panels.

- Since you own your solar panels, you receive the federal tax credit in the first year – in other words, the government essentially pays you the first year if you take advantage of the tax credit.

- In addition, you receive all state and local incentives as well, since you are the owner of the solar panels.

- Solar loans offer immediate savings over your electric bill.

- Zero-down solar loans are widely available.

- Most providers offer a zero-down loan option.

- Initially, zero-down was only available in solar leases or solar PPAs, but now that zero down loans exist homeowners are able to take advantage of financing that allows them to own their panels without an initial cash outlay.

Loan Types – Secured vs. Unsecured vs. Municipally-Financed (PACE Loans)

There are three types of solar loans available today to consumers:

- secured

- unsecured

- municipal financed (PACE)

We drill into the differences in the table below, but the principal difference between the two is that secured loans use your home as collateral, while unsecured loans utilize the solar panels themselves as collateral.

Solar Loan Comparison

| Type | Secured Solar Loans | Unsecured Solar Loans | Municipal Solar Loans (PACE) |

| What is used as collateral? | Home | Solar Panels | Home |

| Is there an FHA Guarantee? | Yes | No | Depends |

| Loan terms | 5-20 years | 5-20 years | Varies |

| Interest rate | 3.5-6.5% | 3.5-9% | 3% and up |

| Is interest tax-deductible? | Yes | No | Yes |

| Special notes | Lower origination fees than unsecured |

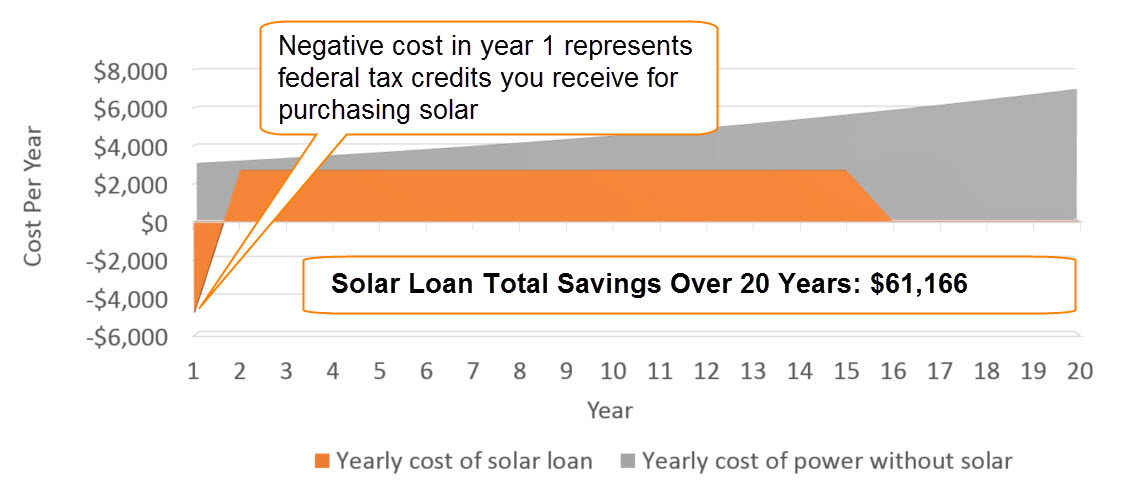

A Solar Loan Example – Savings Over a 20 Year Period With a 15 year Loan

Where Can You Get Solar Loans?

Solar installers, banks, credit unions, and independent financing companies all provide loans, so the options for homeowners are increasing all the time.

If you like to find out more on solar loan rates check the list of our pre-screened providers who offer solar loans along with other financing options.

Ready to See How Much You Can Save with Solar?

Interested in getting exact prices for the cost solar for your home? Get competitive solar quotes from qualified, trusted installers in your area. To see an estimate for how much you could expect to save and how much a solar system would cost, try our solar calculator.